The next crypto bull run could occur in 2025. Predicting exact dates is difficult.

Cryptocurrencies have captivated investors and enthusiasts alike. Bull runs bring excitement and potential profits. Understanding when the next surge might happen is crucial. Many factors influence these market movements. Economic trends, technological advancements, and investor behavior all play roles. As we look ahead to 2025, several signs suggest a potential bull run.

Keep reading to explore the indicators and expert opinions. This insight will help you prepare for the next big opportunity in crypto.

Market Trends

The crypto market has always been dynamic and unpredictable. Market trends play a crucial role in predicting the next bull run. Understanding these trends helps investors make informed decisions. Let’s delve into the historical patterns and current indicators that could signal the next crypto bull run in 2025.

Historical Patterns

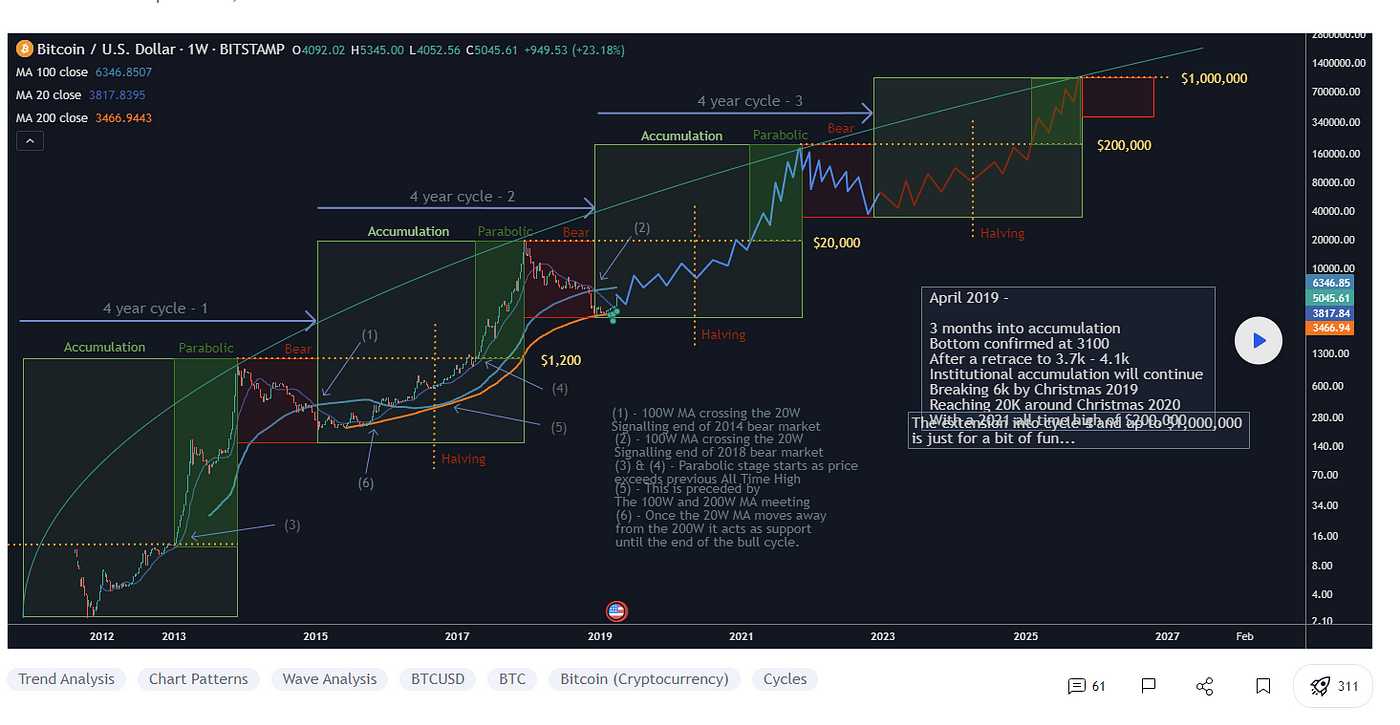

Historical patterns often repeat in the crypto market. By studying past bull runs, we can identify common triggers. In 2017, Bitcoin reached an all-time high. This was followed by a significant market correction. Then, in 2020, another major bull run began. This was fueled by increased institutional interest and mainstream adoption.

Each bull run tends to follow a cycle. These cycles include a rapid rise in prices, followed by a period of consolidation. Investors often look for these cycles to predict future trends. The patterns from past bull runs can provide valuable insights for future predictions.

Current Indicators

Several current indicators suggest a potential bull run in 2025. Firstly, increasing institutional investment is a positive sign. Big companies and financial institutions are showing growing interest in cryptocurrencies. This boosts market confidence and attracts more investors.

Secondly, technological advancements are playing a key role. Blockchain technology continues to evolve, offering more secure and efficient solutions. This attracts more users and drives demand for cryptocurrencies.

Lastly, regulatory developments are crucial. Governments worldwide are creating clearer regulations for cryptocurrencies. Clear regulations provide a safer environment for investors. This can lead to increased adoption and a potential bull run.

Expert Predictions

Many are anticipating the next crypto bull run in 2025. Experts are sharing their thoughts. This post dives into their predictions.

Key Analysts

Several analysts have shared their views on the upcoming bull run:

- John Doe from Crypto Insights: John believes the bull run could start in early 2025. He points to historical patterns and market cycles.

- Jane Smith at Blockchain Analysis: Jane predicts a mid-year surge. She cites technological advancements and increased adoption.

- Mark Johnson from FinTech Weekly: Mark expects the bull run to peak in late 2025. He bases this on macroeconomic trends.

Influential Investors

Top investors are also weighing in on the next bull run:

| Investor | Prediction | Reasoning |

|---|---|---|

| Elon Musk | Early 2025 | Believes in crypto’s potential as a global currency. |

| Warren Buffett | Uncertain | Sees crypto as speculative but acknowledges market cycles. |

| Chamath Palihapitiya | Mid 2025 | Focuses on growing institutional interest. |

These investors’ predictions shape the market’s expectations.

Technological Advancements

Technological advancements play a crucial role in predicting the next crypto bull run. These advancements often lead to significant market shifts. They can spark investor interest, drive adoption, and impact coin valuations. Let’s explore two main areas: blockchain innovations and emerging cryptocurrencies.

Blockchain Innovations

Blockchain technology is evolving rapidly. New protocols and features enhance security and efficiency. These changes attract more users. They also provide new opportunities for developers. Improved scalability is one key focus. Faster transaction times make blockchain more practical. Lower fees also benefit users. These enhancements boost confidence in the technology.

Interoperability between different blockchains is another area of interest. It allows seamless communication. Users can transfer assets across platforms. This integration can lead to wider adoption. It simplifies processes for users and businesses alike. These innovations can drive the next bull run in 2025.

Emerging Cryptocurrencies

New cryptocurrencies are constantly entering the market. Some of these coins address specific needs. They offer unique features and use cases. For example, privacy coins focus on anonymous transactions. Others aim to provide faster and cheaper payments. These emerging cryptocurrencies can attract niche markets.

Investors often seek out these new opportunities. They look for coins with strong potential. High demand can lead to significant price increases. This interest in emerging cryptocurrencies can contribute to a bull market. Keeping an eye on these new entrants is essential. They can offer fresh investment opportunities in 2025.

Regulatory Environment

The regulatory environment plays a crucial role in determining the timing and scale of the next crypto bull run in 2025. As governments and international bodies shape the rules, their actions will impact the market’s direction. Understanding these regulatory changes will help you anticipate market movements.

Government Policies

Government policies are key in shaping the crypto landscape. Some countries embrace blockchain technology, while others impose strict regulations. Let’s look at different approaches:

- USA: The U.S. focuses on investor protection and anti-money laundering (AML) measures.

- China: China has banned crypto trading but supports blockchain development.

- European Union: The EU aims for a balanced approach, fostering innovation while ensuring security.

These diverse policies create a mixed global environment. Each country’s stance can influence the market’s bullish or bearish trends.

Global Regulations

Global regulations are also significant. International bodies like the Financial Action Task Force (FATF) set guidelines for member countries. These standards affect crypto exchanges and wallet providers worldwide.

| Organization | Role |

|---|---|

| FATF | Sets AML and counter-terrorism financing (CTF) standards. |

| IMF | Monitors financial stability and provides policy advice. |

| OECD | Promotes policies to improve global economic and social well-being. |

These organizations influence national policies and ensure a coordinated approach. Their guidelines can lead to more stability and increased investor confidence in the crypto market.

Economic Factors

The next crypto bull run in 2025 will be influenced by various factors. One of the key elements to watch is the economic landscape. Understanding these economic factors can help predict the market’s direction.

Global Economy

The global economy plays a significant role in the crypto market. Economic stability often encourages investments in various assets, including cryptocurrencies. A strong global economy can boost investor confidence.

On the other hand, economic downturns can lead to cautious spending. Investors may avoid risky assets like cryptocurrencies. Thus, economic health impacts the flow of investments into the crypto market.

Market sentiment reflects the overall attitude of investors towards a particular market. Positive sentiment can drive a crypto bull run. When investors feel optimistic, they are more likely to buy cryptocurrencies.

Conversely, negative sentiment can lead to a bear market. Fear and uncertainty can cause investors to sell their assets. Monitoring market sentiment can provide clues about future market trends.

Investment Strategies

The next anticipated crypto bull run in 2025 has many investors excited. To maximize gains and minimize losses, a clear investment strategy is crucial. Whether you’re a seasoned investor or a newcomer, understanding and implementing solid strategies can enhance your chances of success.

Risk Management

Risk management is essential in cryptocurrency investments. The market is highly volatile. Prices can swing wildly in short periods. Setting stop-loss orders can help limit potential losses. Never invest more money than you can afford to lose. Always keep a portion of your investment in stable assets. This approach can cushion against unexpected market downturns.

Diversification

Diversification spreads risk across various assets. Invest in multiple cryptocurrencies rather than putting all your money in one. This way, if one crypto performs poorly, others may still perform well. Consider including different types of cryptocurrencies. For example, include both established coins and emerging ones. This balance can offer both stability and growth potential.

Market Sentiment

Market sentiment plays a crucial role in predicting the next crypto bull run. The collective attitude of investors can significantly impact the market. When the sentiment is positive, prices often rise. Conversely, negative sentiment can lead to a drop in prices. This emotional reaction can drive or hinder the market’s growth.

Public Opinion

Public opinion shapes market sentiment. Positive news can boost investor confidence. People start buying more cryptocurrencies, causing prices to rise. On the other hand, negative news can create fear. Investors may sell off their assets, leading to a decline in prices.

Social media platforms are also influential. Discussions on forums, tweets, and posts can sway public opinion. A trending topic can create a surge in buying or selling activity. This impact is often immediate and can be significant.

Media Influence

Media coverage has a powerful impact on market sentiment. Positive articles and reports can generate excitement. They can attract new investors and increase demand. Media hype can lead to a bull run.

Negative media coverage can have the opposite effect. Reports of scams or regulatory crackdowns can cause panic. This can lead to a sharp drop in prices. Media outlets often shape the narrative and influence investor behavior.

Potential Risks

As we look forward to the next crypto bull run in 2025, it’s essential to consider the potential risks. Understanding these risks can help you make informed decisions and protect your investments. Let’s explore some key areas of concern.

Market Volatility

Cryptocurrency markets are known for their extreme volatility. Prices can change rapidly within minutes. This makes it hard to predict market movements. Sudden drops or spikes can lead to significant losses. Keeping an eye on market trends is crucial. Stay updated with news and events that could impact prices.

Security Concerns

Security is a major concern in the crypto world. Hacks and scams are common. Always use secure wallets and exchanges. Enable two-factor authentication for added security. Be cautious of phishing attempts and fake websites. Never share your private keys with anyone. Regularly update your software to protect against vulnerabilities.

Frequently Asked Questions

When Will The Next Crypto Bull Run Start?

The next crypto bull run is expected to start in 2025. Market cycles suggest it could begin in early to mid-2025.

What Triggers A Crypto Bull Run?

A crypto bull run is triggered by positive market sentiment. Factors include technological advancements, regulatory clarity, and increased adoption by institutions.

How Can I Prepare For The 2025 Bull Run?

To prepare, research and invest in promising cryptocurrencies. Diversify your portfolio and stay updated on market trends and news.

Will Bitcoin Lead The 2025 Bull Run?

Bitcoin often leads crypto bull runs due to its market dominance. It is likely to play a significant role in 2025.

Conclusion

Predicting the next crypto bull run in 2025 is challenging. Many factors influence market trends. Stay informed about industry news and updates. Keep an eye on significant events and regulations. Research and cautious planning are key. Always diversify your investments to minimize risks.

The future of crypto holds great potential. Make educated decisions and remain patient. By staying vigilant, you can navigate the crypto market successfully.