A bull run in crypto is a period of rising prices. It’s characterized by strong investor confidence and high market activity.

In the world of cryptocurrencies, a bull run can be exhilarating. Prices surge, optimism grows, and many investors see significant gains. But what exactly causes these price spikes? Understanding a bull run helps you make informed decisions. It’s crucial for anyone involved in crypto trading.

Whether you’re a seasoned investor or new to the market, knowing the signs of a bull run can be beneficial. This knowledge can help you navigate the often unpredictable crypto market. Let’s dive into what a bull run in crypto truly entails.

Introduction To Bull Run

In the world of cryptocurrency, the term “bull run” often creates excitement. It represents a period where prices rapidly increase. Investors eagerly await these periods to make significant gains. Understanding a bull run can help in making informed investment decisions. Let’s dive into what exactly a bull run is and its historical significance.

Defining A Bull Run

A bull run is a market condition where prices rise over a period. This increase is usually significant and sustained. It reflects strong investor confidence and optimism. During a bull run, more people buy than sell. This demand drives prices up further. In crypto, bull runs can bring massive profits.

Historical Context

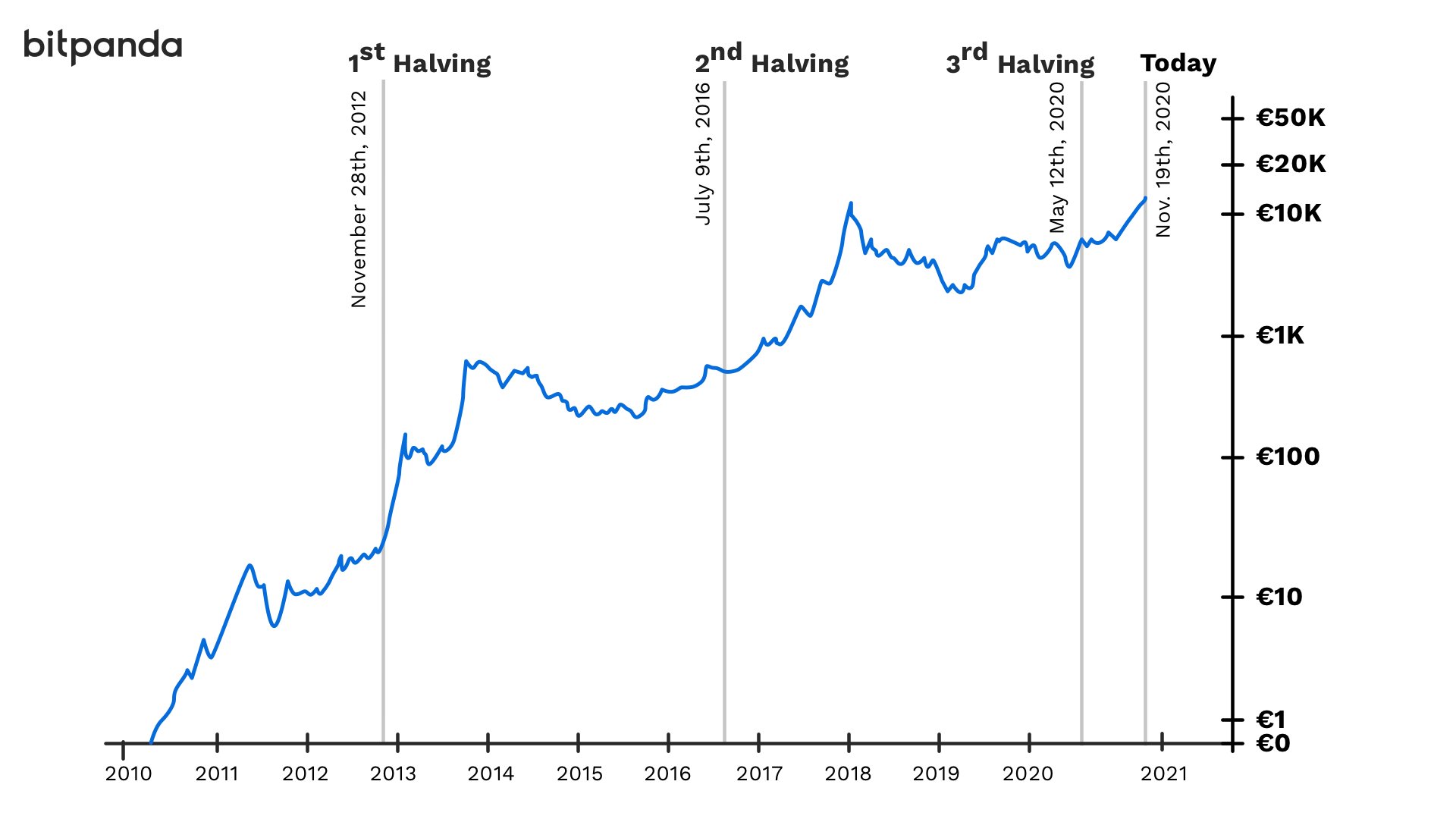

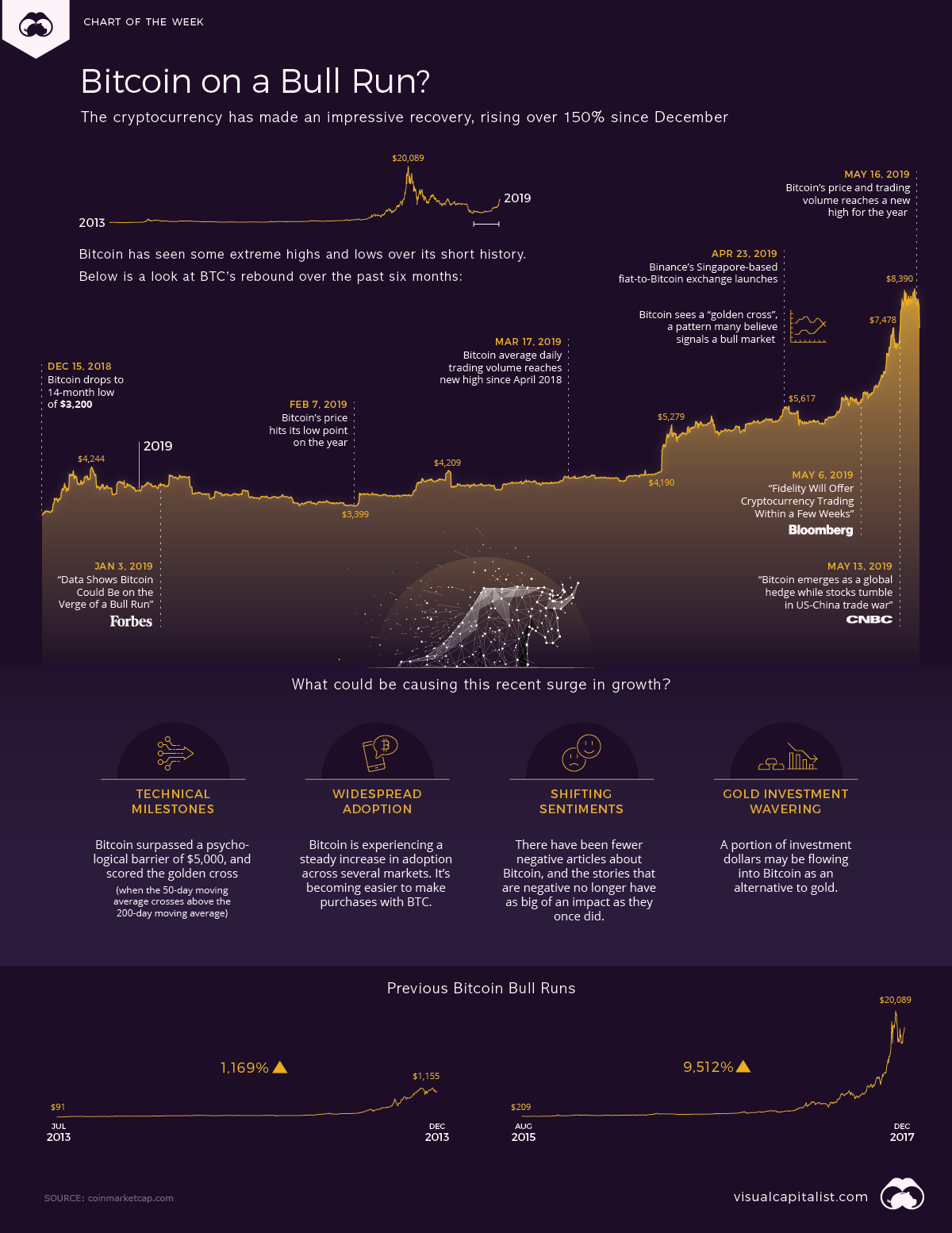

Bull runs have occurred in various markets, including stocks and real estate. In crypto, they are often more intense. One famous example is the bull run of 2017. Bitcoin’s price soared from $1,000 to nearly $20,000. Another notable bull run happened in 2020-2021. Bitcoin’s price surged past $60,000. These periods attract new investors and media attention. They also lead to increased adoption and development in the crypto space.

Key Indicators

A Bull Run in crypto refers to a period of rising prices. Understanding the key indicators can help you identify the start of a Bull Run. These indicators provide valuable insights into market trends. By monitoring them, you can make informed decisions.

Market Sentiment

Market sentiment plays a crucial role in a Bull Run. Positive news and developments boost investor confidence. This leads to increased buying activity. Social media platforms and news outlets often reflect this sentiment. Pay attention to the general mood among investors. Optimism and excitement usually signal a Bull Run.

Trading Volume

Trading volume is another key indicator of a Bull Run. High trading volumes indicate strong market activity. This usually means more people are buying than selling. Consistent increases in trading volume suggest growing interest. It also indicates that more money is flowing into the market. Keep an eye on daily trading volumes to spot a Bull Run early.

Economic Factors

Understanding economic factors can help explain a bull run in crypto. These factors shape investor behavior and market dynamics. Let’s explore two key economic factors: inflation and monetary policy.

Inflation Impact

Inflation affects the value of money over time. When inflation rises, traditional currencies lose value. People often look for alternative investments. Crypto can be one of these investments. Bitcoin, for example, has a limited supply. This scarcity can make it attractive during high inflation. More demand can lead to a bull run. Investors may see crypto as a hedge against inflation. This belief can drive prices up quickly.

Monetary Policy

Monetary policy involves how central banks control the money supply. Low interest rates and quantitative easing can increase money in the economy. This extra money often flows into investments, including crypto. Central banks may print more money during economic downturns. This action can lead to more investors seeking out crypto. They do this in hopes of higher returns.

Changes in monetary policy can create uncertainty. This uncertainty can drive people towards crypto. They see it as a stable investment. Increased buying can cause prices to rise. This can trigger a bull run. Watching central bank policies can give clues about future market trends.

Technological Drivers

A bull run in crypto often stems from technological drivers. These advancements fuel investor confidence and market growth. Let’s explore some key technological drivers that spark bull runs in the crypto market.

Blockchain Advancements

Blockchain technology evolves rapidly. Innovations in blockchain make transactions faster and cheaper. Improved scalability allows more users to join the network. Secure and transparent systems build trust among users. These advancements attract new investors. Market enthusiasm grows, leading to a bull run.

New Cryptocurrencies

New cryptocurrencies emerge frequently. Each new coin offers unique features. Some promise better security. Others focus on faster transactions. New coins often generate buzz and excitement. Investors seek the next big opportunity. This enthusiasm can drive a bull run. New coins also bring diverse investment options. The market expands with each new entry.

Investor Behavior

A bull run in crypto often excites investors. They flock to the market with high hopes. Understanding investor behavior during this period is key. Different types of investors act in unique ways. Let’s explore how retail and institutional investors behave during a crypto bull run.

Retail Investors

Retail investors are everyday people. They often enter the market during a bull run. Many of them follow trends and hype. They buy when prices rise. Fear of missing out drives their decisions. Social media and news influence their actions. They seek quick profits. Sometimes, they lack deep market knowledge. This can lead to impulsive buying.

Institutional Investors

Institutional investors are professional entities. They include banks, hedge funds, and large corporations. Their approach is more strategic. They invest large sums of money. They conduct thorough research before buying. They aim for long-term gains. Their presence can stabilize the market. They bring credibility and trust to the crypto space. Their investments often signal market confidence.

Regulatory Environment

A bull run in crypto is a period when prices rise rapidly. The regulatory environment plays a key role during such times. It can either help or hinder the growth of the market. Understanding the regulatory environment helps investors make informed decisions.

Government Policies

Government policies impact the crypto market significantly. Clear and supportive policies encourage investment and growth. Uncertain or restrictive policies can lead to market volatility. Governments worldwide take different approaches to crypto regulation. Some embrace it, while others remain cautious.

Legal Challenges

Legal challenges in the crypto space are common. These challenges can arise from unclear regulations or enforcement actions. Legal issues can create fear and uncertainty among investors. This can affect the overall sentiment during a bull run. Addressing legal challenges quickly is essential for market stability.

Market Risks

Market risks are ever-present in the world of cryptocurrency. During a bull run, these risks can be amplified. Understanding these risks can help investors make informed decisions.

Volatility Concerns

Crypto markets are known for their extreme volatility. Prices can swing wildly within minutes. This unpredictability poses a significant risk. Investors may see large gains or devastating losses.

Volatility can be influenced by various factors. News events, regulatory changes, and investor sentiment play roles. These elements can cause rapid price changes. High volatility often means high risk.

Market Manipulation

Market manipulation is a common issue in crypto. Large players can influence prices. They might use tactics like pump-and-dump schemes. These schemes inflate prices before selling off assets. This leaves smaller investors at a loss.

Another form of manipulation is spoofing. Traders place large orders they don’t intend to fill. This creates a false sense of demand or supply. It can mislead other investors, affecting market prices.

Staying aware of these risks is crucial. It helps investors navigate the unpredictable crypto market. Being informed can mitigate potential losses.

Future Predictions

Future predictions in the crypto world often spark curiosity. Enthusiasts want to know if another bull run is on the horizon. Let’s explore the potential scenarios and what they could mean for the market.

Long-term Trends

Long-term trends in crypto show significant growth and adoption. More businesses accept cryptocurrencies as payment. Governments and institutions are exploring blockchain technology. This growing acceptance could drive the next bull run.

Stablecoins and decentralized finance (DeFi) are gaining popularity. These innovations make crypto more accessible to average users. With more people entering the market, the demand for cryptocurrencies could rise.

Potential Challenges

Potential challenges could impact the next bull run. Regulatory changes could slow down market growth. Governments may introduce stricter rules for trading and ownership.

Security concerns also pose a risk. Hacks and scams could undermine trust in cryptocurrencies. Investors may hesitate to enter the market if they fear losing their funds.

Market volatility remains a critical issue. Prices can swing wildly in short periods. This unpredictability may deter some investors from participating.

Frequently Asked Questions

What Is A Bull Run In Crypto?

A bull run in crypto is when prices rise continuously. This typically attracts more investors. It usually signals a strong market sentiment.

How Long Does A Bull Run Last?

Bull runs can last from a few weeks to several months. Duration varies based on market factors. Historical data offers some insights.

What Triggers A Crypto Bull Run?

Positive news and market sentiment often trigger bull runs. Increased adoption and technological advancements can also play a role.

How Can You Spot A Bull Run?

Watch for sustained price increases and high trading volumes. Positive news and strong market sentiment are also indicators.

Conclusion

A bull run in crypto can offer exciting opportunities. Prices rise quickly, creating potential profits. Investors should stay informed and cautious. Bull runs can be unpredictable. Always research and understand the market. Manage risks wisely. Engage with reliable sources and communities.

This helps you stay updated. Enjoy the ride, but remain aware. Crypto markets can change rapidly.